Experience hassle-free digital payments with our cutting-edge solutions.

Elevate your business with expert marketing and advertising strategies.

Embrace the future of commerce today!

Unlocking the Future: The Magic of Seamless Digital Payments and Smart

Marketing

Welcome to the digital age, where your wallet lives in your phone and paying

for your morning coffee is just a tap away. The world of finance has seen a

revolutionary shift towards digitalization, making seamless digital payments

not just a convenience, but a necessity. But how do businesses make the most of

this shift? That's where expert marketing and innovative advertising

solutions come into play. Let's dive into how unlocking payment innovation

and integrating expert marketing strategies can transform the digital

finance landscape.

|

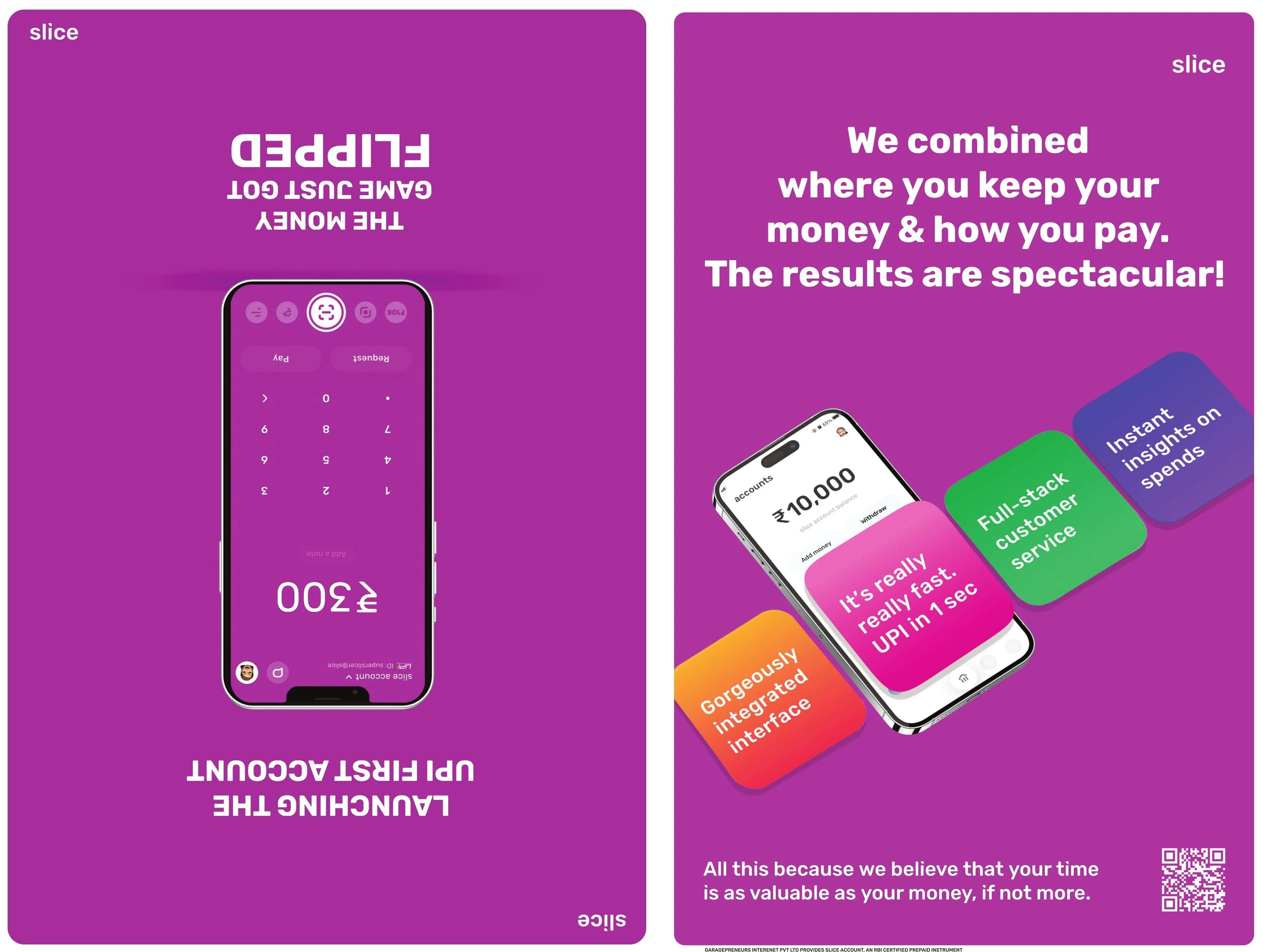

| Image Credit: Sliceit |

The Dawn of Digital Transaction Expertise

Gone are the days of counting cash or waiting in long bank queues. The era

of seamless digital payments has arrived, offering unmatched convenience

and speed. But, what powers this transformation? At its core, digital

transaction expertise plays a pivotal role. Businesses that harness this

expertise don't just keep up; they lead the way in offering streamlined

financial transactions that delight customers.

Moreover, integrating this expertise with cutting-edge payment methods

isn't just about keeping transactions smooth. It's also about crafting enhanced

payment experiences that resonate with users, making every tap, swipe, or click

a positive part of their day.

The Art of Marketing for Fintech

Marketing in the digital finance sector requires a blend of creativity and

understanding of the latest payment technology trends. It's not just about

telling people that your service exists; it's about illustrating the seamless

experience and convenience it brings to their lives. Expert marketing in

this field involves educating potential users about the benefits of digital

wallets and innovative payment solutions through engaging content and

persuasive narratives.

Furthermore, advertising solutions for financial apps go beyond

traditional banners and TV spots. They involve carefully crafted ad campaign

optimization strategies that target the right audience at the right time,

turning views into clicks and clicks into loyal users.

Harnessing Payment Technology Strategies

In the fast-evolving world of digital payments, staying ahead means being in

tune with the latest payment technology trends. Businesses that leverage these

trends can offer integrated payment solutions that not only simplify

transactions but also add value to the user experience. This could mean

implementing digital wallet promotions that offer rewards for digital

transactions or introducing new payment features that cater to niche markets.

|

| Image Credit: PhonePe |

Payment technology strategies also involve analyzing market data to

predict future trends, ensuring that businesses remain competitive and

innovative in offering payment solutions that meet evolving consumer demands.

Ad Campaign Optimization: A Key to Success

The success of fintech marketing heavily relies on ad campaign

optimization. This means not just creating ads, but creating the right ads

and placing them where they will have the most impact. Effective advertisements

for financial apps are designed with the user in mind, focusing on the

convenience and security of digital payment solutions.

By continuously testing and tweaking campaigns based on performance data,

businesses can significantly improve their reach and conversion rates. This

approach ensures that marketing resources are used efficiently, maximizing

return on investment in the competitive digital finance sector.

Expertise in Payment Marketing: The Secret Ingredient

What sets successful digital payment solutions apart is not just the

technology behind them, but the expertise in payment marketing that promotes

them. Marketing strategies for finance apps must go beyond surface-level

features and delve into how these apps enrich users' lives. Whether it's

through storytelling, influencer partnerships, or interactive digital

experiences, the goal is to connect with potential users on a personal level.

|

| Image Credit: MobiKwik |

This expertise also involves understanding the nuances of marketing in the

digital economy, where consumer behaviors and expectations are constantly shifting.

Brands that excel in payment marketing are those that listen to their audience

and adapt their strategies to meet these changing needs.

Unlock Payment Innovation with Digital Payment Consultancy

Navigating the complexities of the digital payment landscape can be

challenging for businesses. This is where digital payment consultancy

comes in, offering a roadmap to unlock payment innovation. Consultants

provide valuable payment industry insights, helping businesses identify

opportunities to enhance their payment solutions and stay ahead of the curve.

From advising on the integration of innovative payment solutions to

recommending adjustments to existing payment infrastructures, these experts

play a crucial role in shaping the future of digital transactions.

Integrated Payment Solutions: The New Normal

The integration of payment solutions into everyday apps and services has

transformed the way we think about transactions. Integrated payment

solutions offer a frictionless experience, allowing users to make payments

without leaving the app or website they are using. This not only simplifies the

process but also enhances user satisfaction by offering a seamless transaction

experience.

Businesses that embrace these solutions can tap into new revenue streams and

build stronger relationships with their customers, proving that convenience and

efficiency are key drivers in the digital economy.

Streamlined Financial Transactions: Beyond Convenience

The impact of streamlined financial transactions extends beyond the

convenience they offer. They represent a shift towards a more inclusive digital

economy, where access to financial services is not limited by physical

barriers. This inclusivity opens up new markets for businesses and empowers

consumers from all walks of life.

Additionally, streamlined transactions reduce the operational costs

associated with traditional payment methods, allowing businesses to allocate

resources more effectively and focus on growth and innovation.

Fintech Promotional Campaigns: Telling Your Story

Fintech promotional campaigns are your opportunity to tell your brand's

story and connect with your audience on an emotional level. These campaigns

should highlight how your digital payment solutions solve real-world problems,

making life easier and more enjoyable for users. Through creative storytelling,

engaging visuals, and targeted messaging, fintech brands can capture the

imagination of potential users and stand out in a crowded market.

Effective campaigns also leverage social proof, such as user testimonials

and case studies, to build trust and credibility with the audience, encouraging

them to embrace new payment technologies.

Innovative Payment Solutions: The Future is Here

The future of digital payments lies in the continuous innovation of payment

solutions. From biometric authentication for enhanced security to

blockchain-based transactions for greater transparency, the possibilities are

endless. Businesses that invest in developing and adopting these innovative

solutions will lead the charge in the digital finance revolution.

|

| Image Credit: National Payments Corporation of India |

Moreover, staying ahead in this space requires a commitment to ongoing

research and development, ensuring that payment solutions not only meet current

consumer expectations but also anticipate future needs.

Marketing Strategies for Finance Apps: A Comprehensive Approach

Creating effective marketing strategies for finance apps requires a

comprehensive approach that encompasses everything from understanding your

target audience to leveraging the latest digital marketing tools. It's about

creating a cohesive brand message that communicates the value and benefits of

your app in a way that resonates with potential users.

This approach includes a mix of content marketing, search engine

optimization, social media engagement, and targeted advertising, all designed

to build awareness and drive adoption of your digital payment solutions.

As we've explored, the intersection of seamless digital payments and expert

marketing is where true innovation lies. By understanding and leveraging digital

transaction expertise, payment technology strategies, and cutting-edge

marketing techniques, businesses can unlock new opportunities in the digital

finance sector. The future belongs to those who embrace these changes, offering

solutions that not only meet the practical needs of consumers but also enhance

their daily lives through convenience and simplicity.

Whether you're a startup looking to disrupt the market or an established

player aiming to solidify your position, the key to success lies in your

ability to integrate innovative payment solutions with strategic marketing

efforts. The journey towards digital finance excellence is complex, but with

the right expertise and approach, the possibilities are limitless.

Embracing this digital transformation requires not just technological

adoption but also a keen understanding of the market and the ability to connect

with consumers on a deeper level. The synergy of seamless digital payments

and strategic marketing efforts paves the way for a future where financial

transactions are not just transactions but experiences that enrich our lives.